Rocky Mountain Area Natural Gas Daily Price Review – February 2026

Brian Jeffries

The review of daily prices in January prepared last month opened with the following:

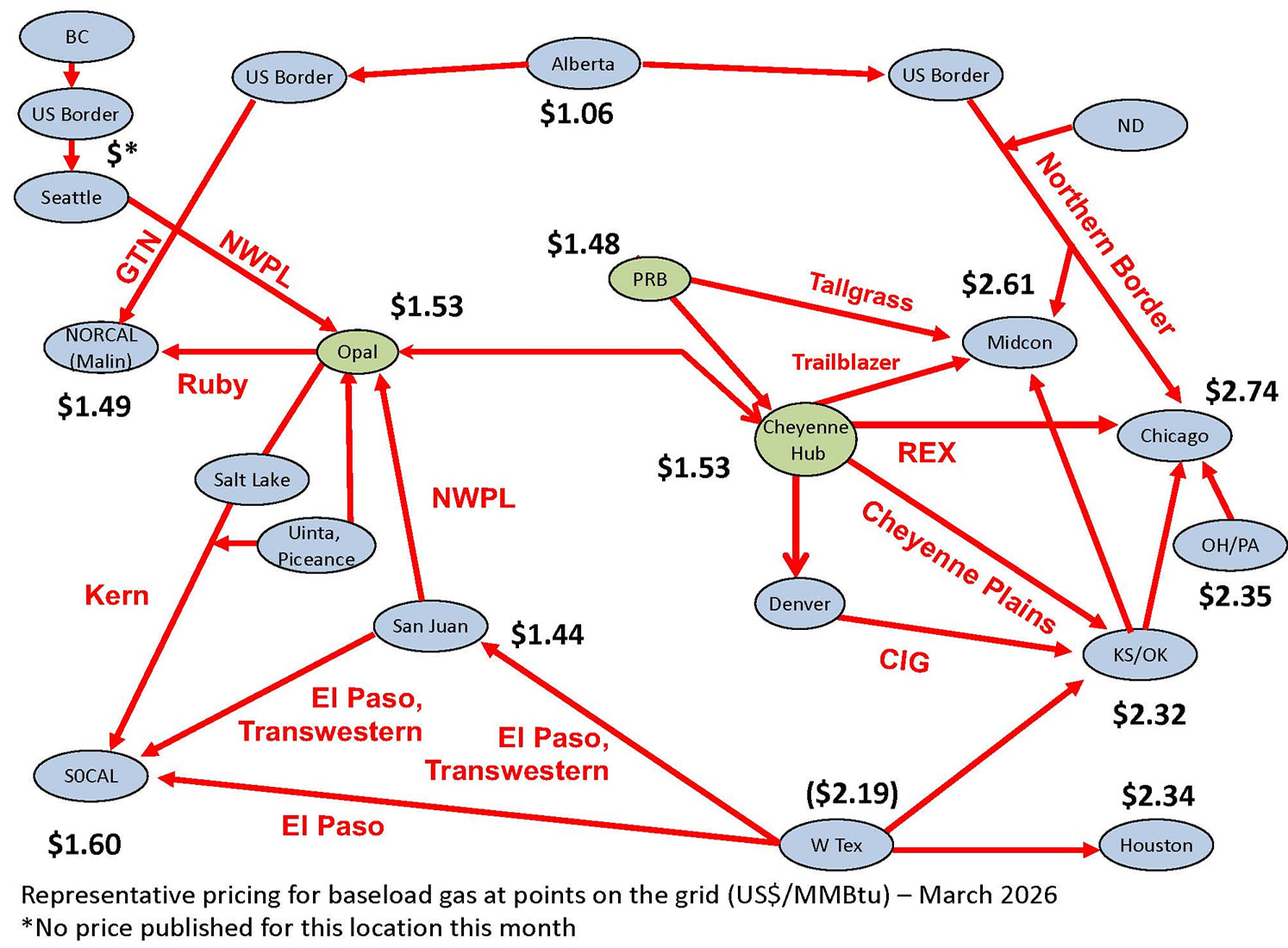

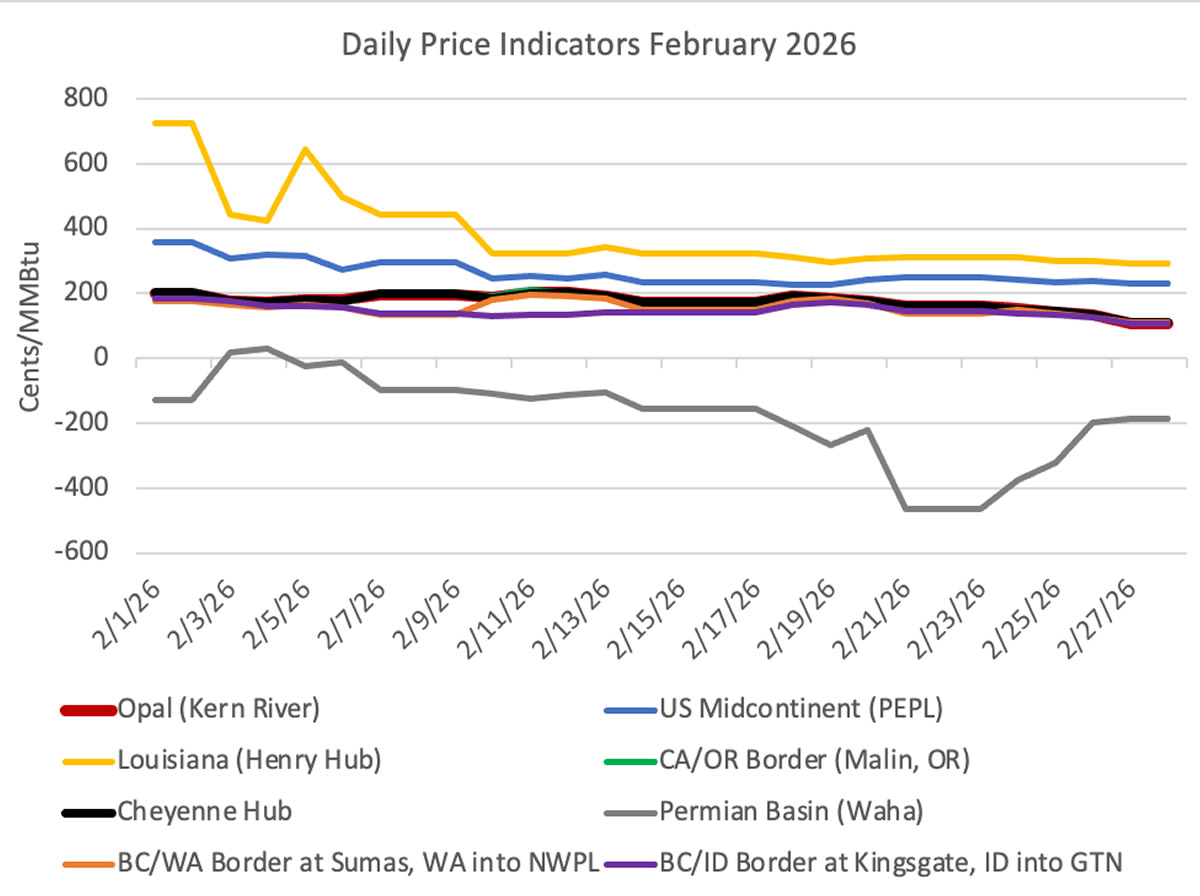

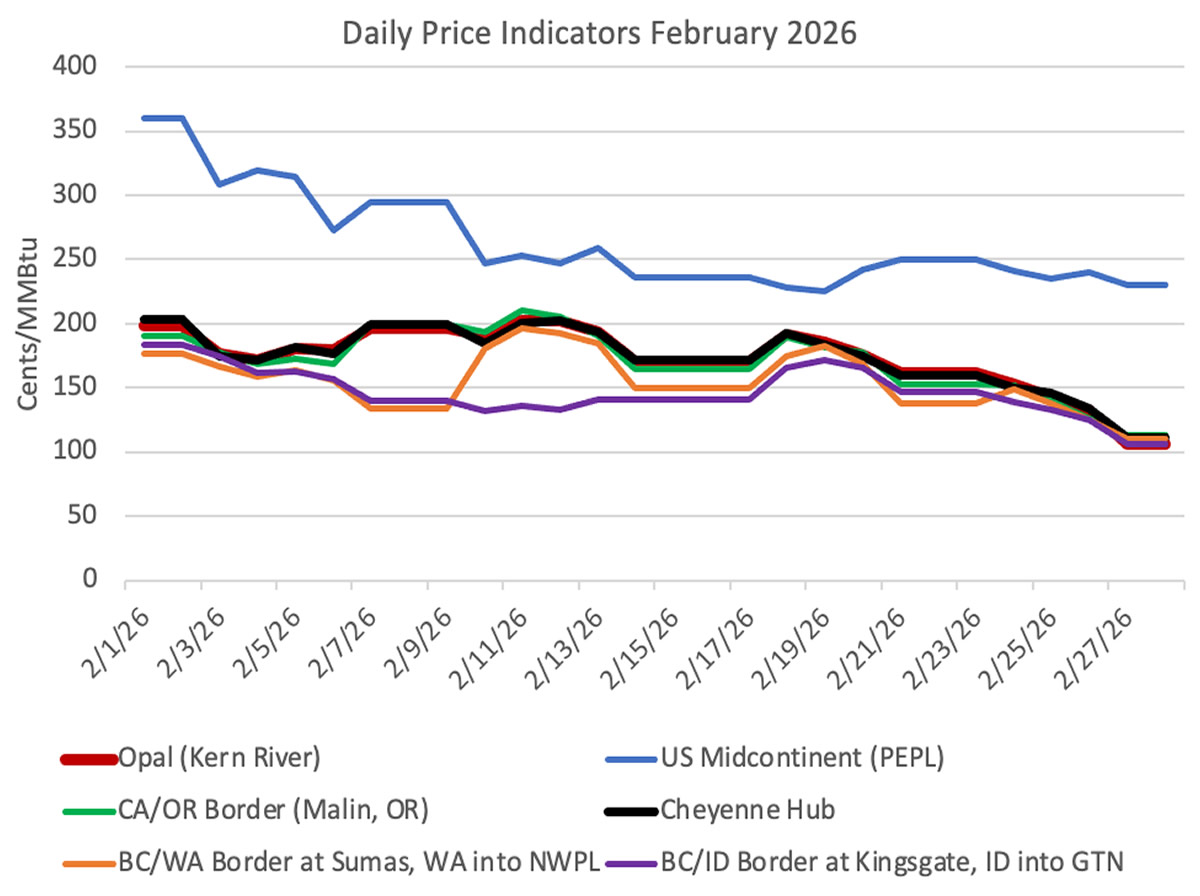

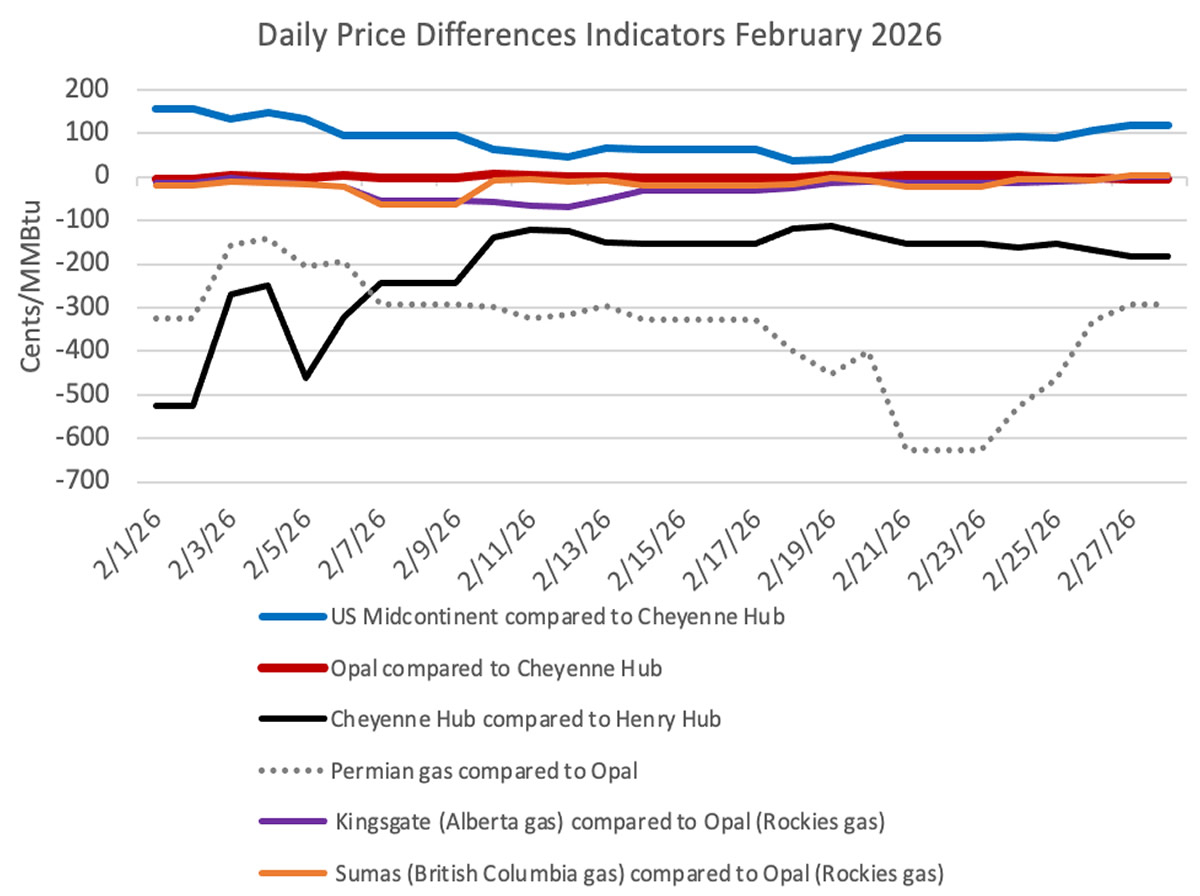

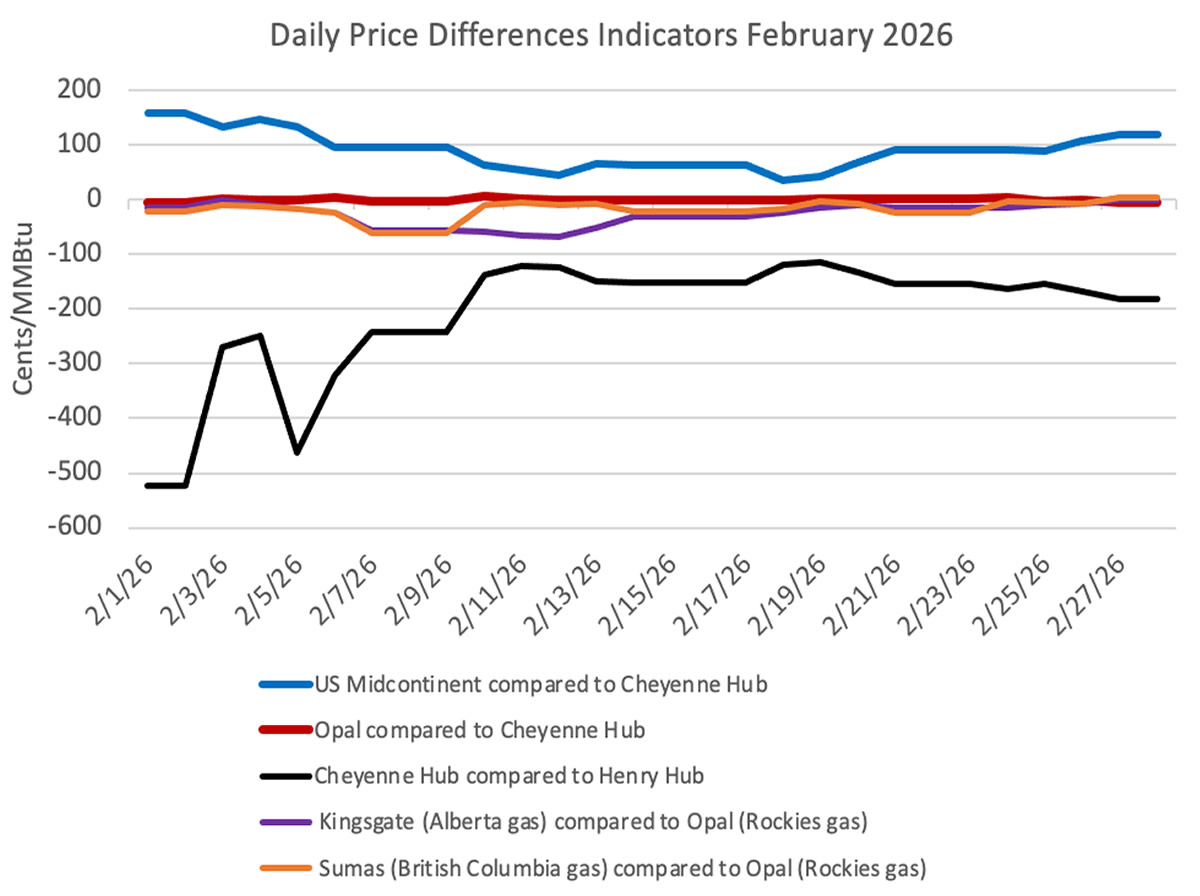

The graphs of daily prices in January 2026 offer a dramatic illustration of what happens when unusually cold weather grips a portion of the US. In late January, cold weather in the midcontinent and eastern US quickly increased natural gas demand in the middle and eastern portions of the country. Daily prices in the New England/New York area hit $90/MMBtu and prices in the midcontinent hit $40/MMBtu. Those prices served to pull gas from the Rockies area into the midcontinent with an associated positive impact on Rockies prices. However, as the cold abated, prices quickly fell back to more normal ranges and Rockies prices declined in sympathy. Note that during this large run up in daily prices in the Midwest, prices in the Pacific Northwest (Sumas) and Northern California (Malin) changed little.

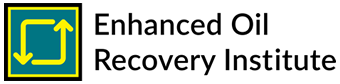

What goes up dramatically often comes down dramatically. The chart directly below depicts the all-month price for January (often called the First of the Month price or FOM) at Opal, the daily spot price at Opal for January 2026 and the resulting average daily spot price for that month. Keep in mind that daily prices typically represent 10 to 20 percent of total production. The few days of extraordinary pricing at the end of January pulled the average daily price for the month above the price established at the start of the month and that applies to each day of the month (a.k.a. the First of the Month price or FOM price). The FOM is a single price that applies to a constant daily quantity for each day of the month.

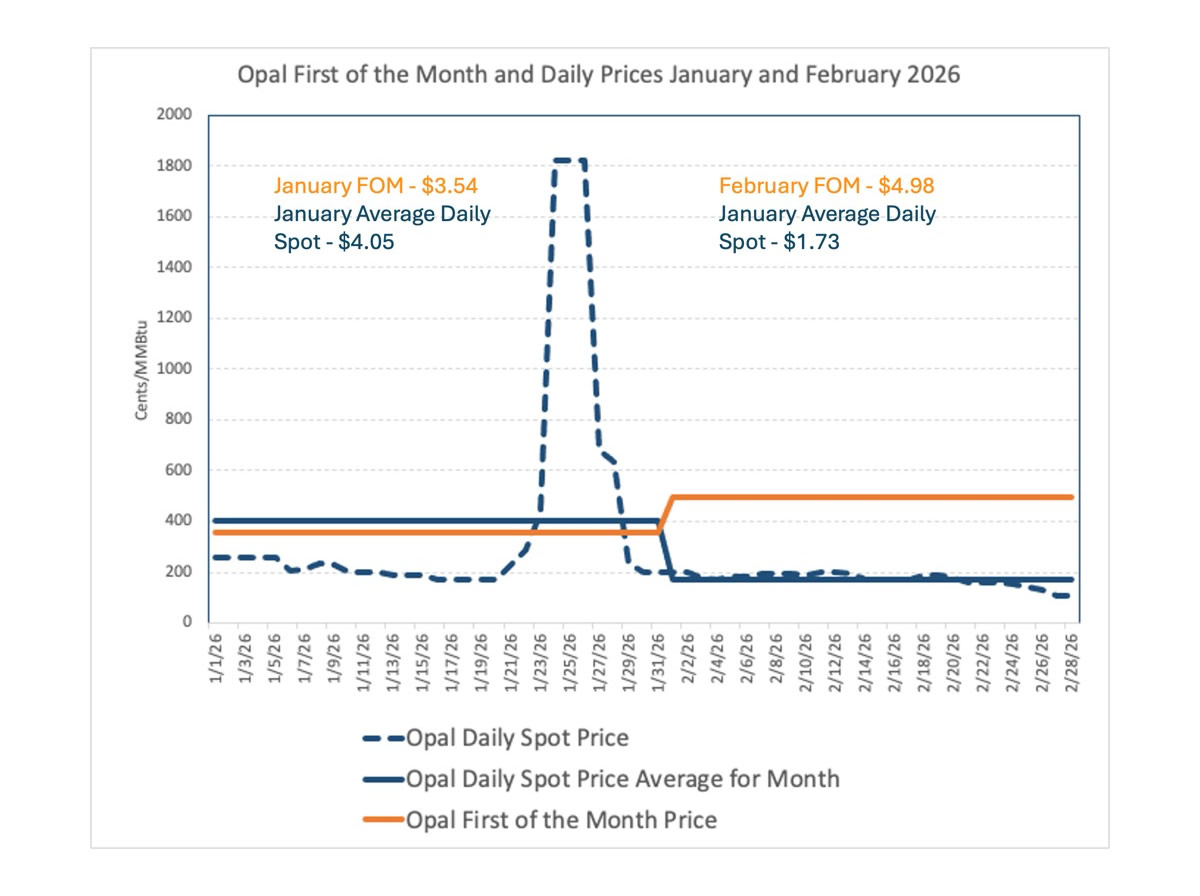

The next chart depicts the all-month price for February 2026 at Opal, the daily spot price at Opal for February 2026 and the resulting average daily spot price for that month. The rapid collapse of daily prices that began at the end of January carried into February. The reason for the anemic daily prices in the majority of January and all of February is the muted winter weather in the Western US. The brief jump in spot prices in late January was caused by very cold weather in the Midcontinent US that caused a brief pull on western US gas supplies.

Trying to predict how daily prices will vary from the FOM price for an upcoming month is indeed a tricky business. The usual monthly price charts follow.